Betfair’s Biden Blunder May Cost Company Half A BILLION

Check out our home page for the most original global news analysis online

Last night, Betfair/Paddypower made one of the costliest legal blunders in Corporate history by settling early in their presidential betting market for Biden. The blunder adds yet another layer of intrigue to the Election battle that just keeps on giving – and legal action has already begun in Australia.

Betfair’s holding company (Flutter Entertainment – created after Betfair & Paddy Power merged in 2019) have exposed themselves to a future liability of an estimated 500 million euros should Donald Trump be re-elected. Even if he isn’t elected, their mistake will cost them tens of millions in refunded bets. The company’s revenue in 2019 was 2.14 Billion.

Ongoing Trump & citizen legal challenges allege widespread voter fraud in key swing state cities, where video evidence and thousands of sworn affidavits in testimony has been revealed.

If you only watch Trump-deranged mainstream media, you would be forgiven for being slightly confused.

From the UK to the USA, and all the way to Australia (Sky News Australia excepted), the mainstream media has told the world that the US election is over, and that Trump is a usurping despot.

But before you laugh, scoff, and switch off, it is worth noting that Presidential electors from Pennsylvania, Georgia and Arizona and other states just yesterday voted for Donald Trump at their State houses – despite the projected electors and notional popular vote declaring for Biden.

Crucially, this symbol of an officially contested election also has legal precedent – in 1960 two sets of electors were also sent in the Nixon/Kennedy election certification process.

This move by Republicans was more than simply defiant symbolism from ‘the deplorables’ – the move was an essential part of a legal strategy by the Trump team to leave all options open for certification on January 6th in congress. If you are an investor in Betfair/Flutter shares, pay attention.

The Midnight run

Last night (14/15 December) at around midnight GMT, Betfair exchange settled their ‘To Be the Next President’ betting market online with just under two billion euros in matched bets outstanding. They declared Biden the winner and Trump the loser.

On Betfair exchange Punters bet against each other rather than the house – with one side making bets and the other side taking bets by giving odds. Betfair take a small commission from whomever wins each matched bet – roughly 5% of every winning bet.

We estimate that three quarters of the almost Two Billion euros that were outstanding in wagers were bets on Biden to win, based on our previous report on the presidential election betting market a few weeks ago

Betfair settled the market last night with no warning to customers, having communicated to customers that they had essentially changed the market rules and would keep it open pending legal challenges and uncertainty.

Remember, by settling the market, the people who took bets on Biden lost and had to pay the people who bet on Biden. Remember this as it is important. So, what exactly is the issue?

Betfair’s half a billion legal blunder

On every gambling market in every online bookmaker, there are market-rules. This goes for traditional bookmakers as well as betting exchanges like Betfair. These rules set out the terms and conditions of the market, and they generally provide for all eventualities. Here are Betfair’s rules for their ‘To Be the Next President’ Market – the paragraph in bold is key.

One reason to object to Betfair settling bets while legal challenges are pending is the fact that ‘The Next President’ is the name of the market, and Biden is not yet ‘The Next President’.

However, when this gets to court (and it will go to court within class action suits if Trump wins), the legal decision will be based on the official communications that Betfair made to their customers on the nature and rules of the market, and on their actions since the election.

There are two absolutely key points in their rules above that have opened them up to breach of contract lawsuits and more. The bolded paragraph about Projected electors, and the reference to the 12th Amendment of the US constitution in the same paragraph.

Projected Electors as a basis for market settlement

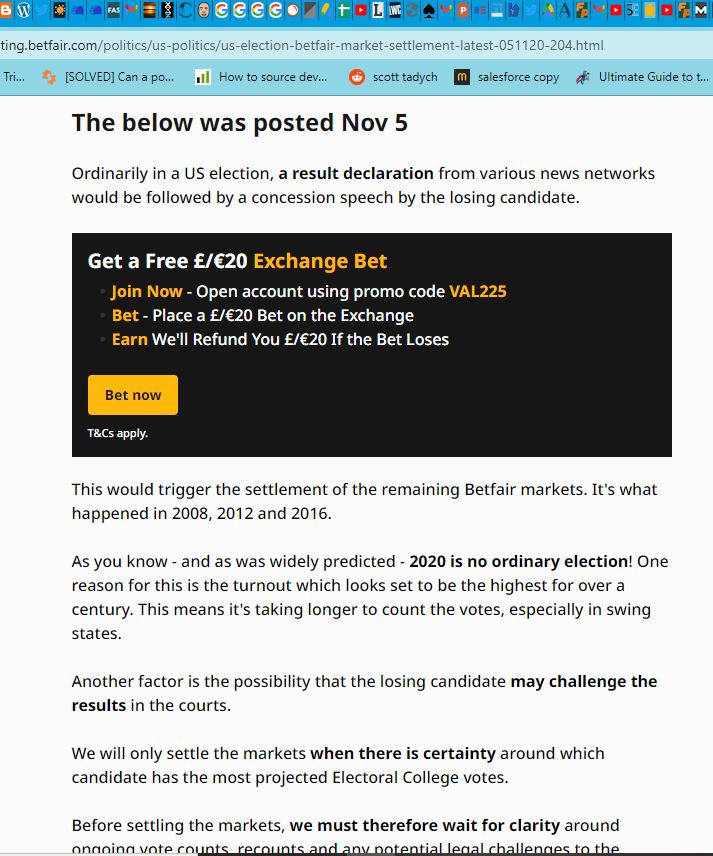

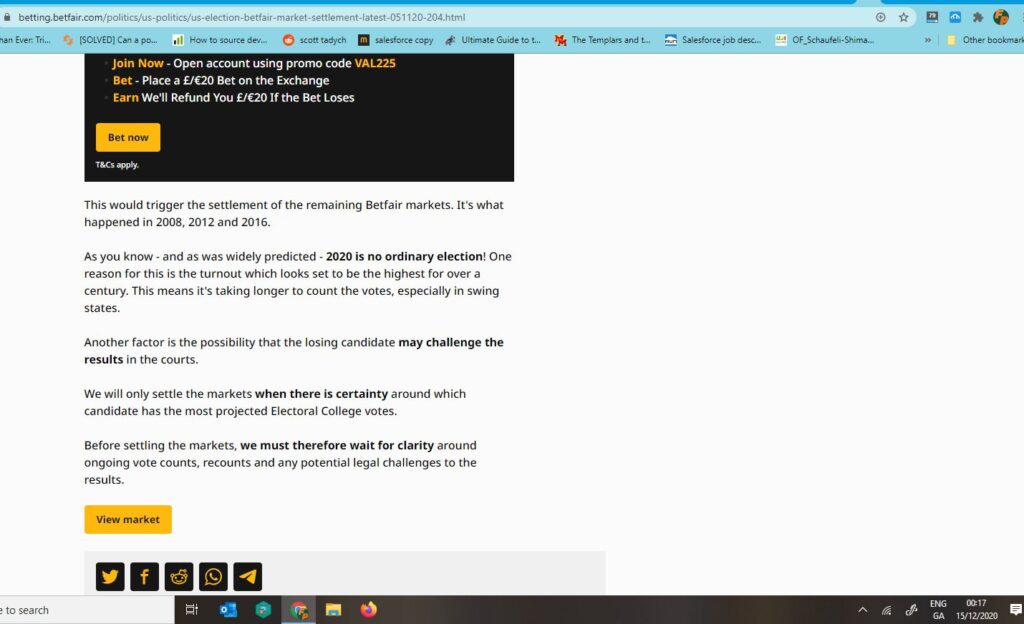

The rules state, “This market will be settled according to the candidate that has the most projected Electoral College votes won at the 2020 Presidential Election”.

The problem here for Betfair is that from November 4th, news networks like Fox & CNN had projected Biden having well over the required projected elector number of 270 votes. But they didn’t close the market then – they kept taking bets and therefore making commissions on the eventual winners.

Betfair exchange kept the market open until the morning of the 15th of December, allowing literally a billion euros more in bets to be placed after November 4, while the projected electors situation essentially remained unchanged.

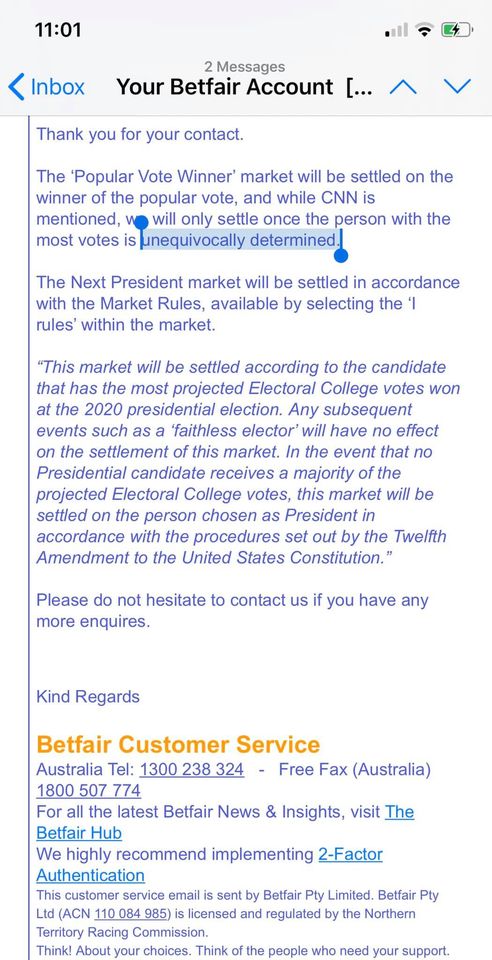

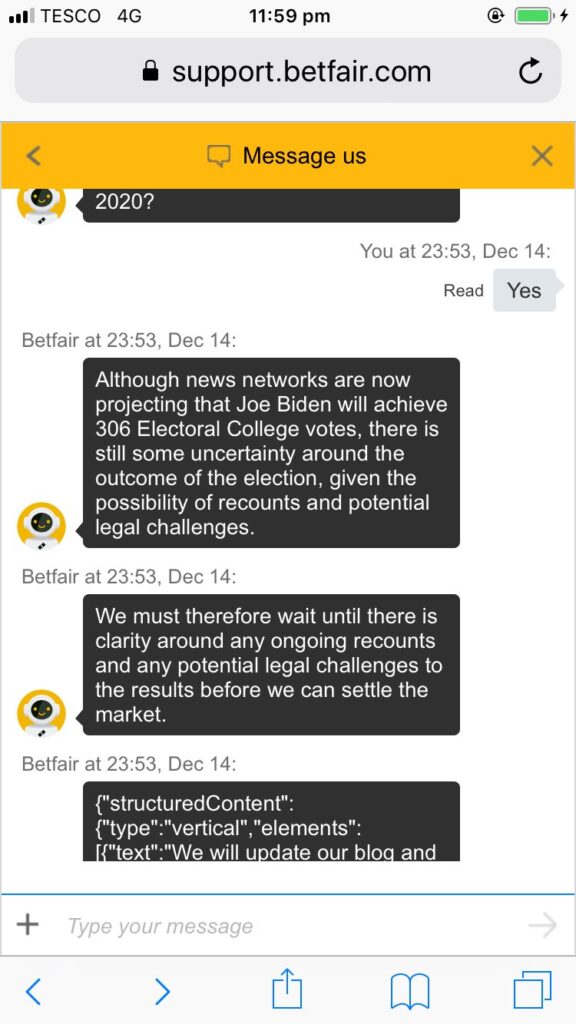

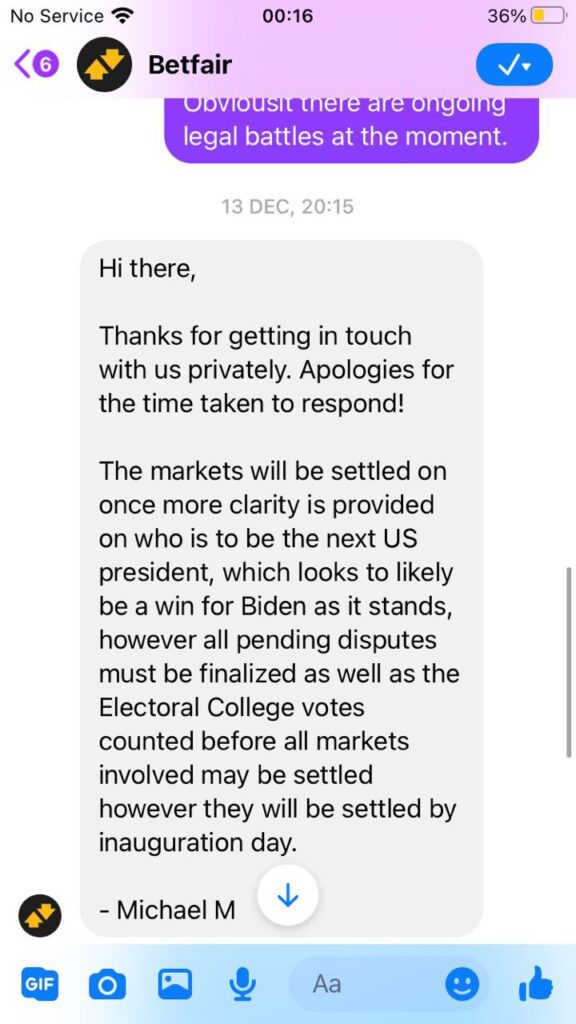

This clearly violated their own rules as you can see above. Indeed, there are multiple saved communiques from customers of Betfair enquiring whether the market would remain open based on legal challenges, and Betfair confirmed that would be the case.

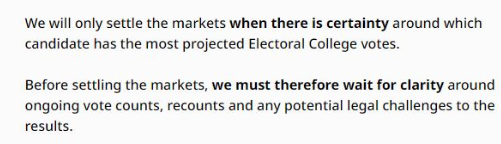

Customers were told that ‘Betfair was waiting for certainty, pending legal challenges’ or words to that effect. There’s more in the image resource below. This implied that the original rules had certainly changed, and it was ok to keep betting while legal challenges were ongoing.

Let’s pause for a second. You may say that the projected elector votes were not official yet, so Betfair were right to leave the market open. And you would be right that they were indeed not official (and arguably they are still not official).

However, on December 4th, California certified its electors thereby officially securing enough projected electors – 279 – for Biden to theoretically be elected and certified on January 6th. You can read more about that here. Important to note: there is no mention of ‘official’ in Betfair’s rules, but this is a defence they may rely on in court.

Betfair kept the market running and taking bets worth hundreds of millions of euros for 11 more days after that ‘official’ 4th of December day that took Biden over 270 electoral votes. So their justification for closing the market yesterday (because projected electors were achieved by Biden) means they should have closed the market on the 4th of November, or the 4th of December. That justification is therefore problematic for Betfair from a legal perspective.

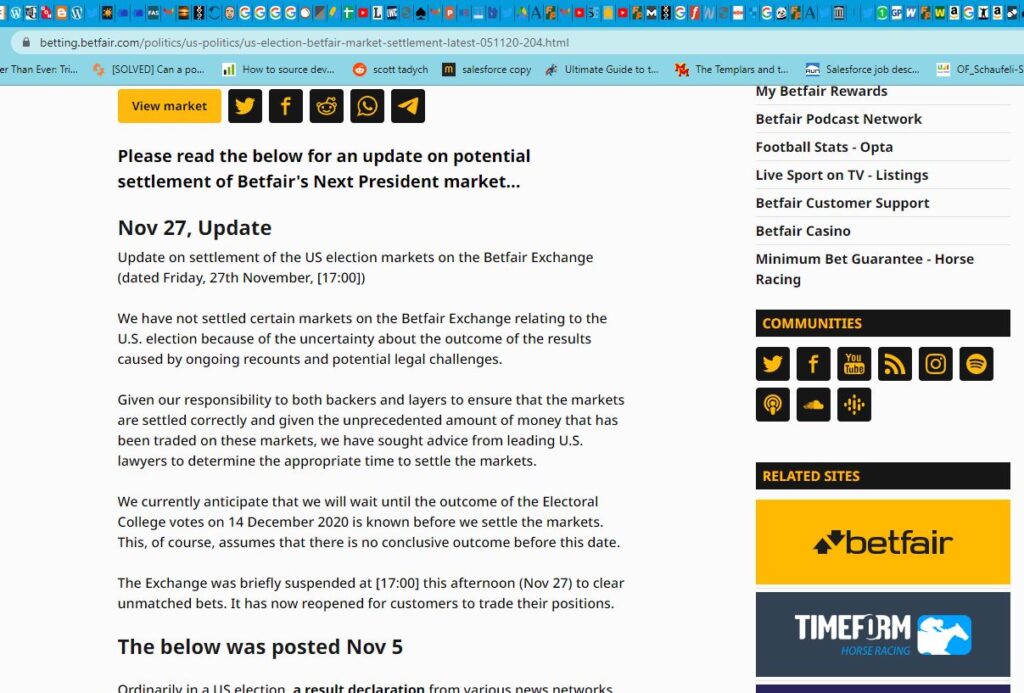

On the 27th of November Betfair issued an official communication on its website:

“We have not settled certain markets on the Betfair Exchange relating to the U.S. election because of the uncertainty about the outcome of the results caused by ongoing recounts and potential legal challenges”, and “We currently anticipate that we will wait until the outcome of the Electoral College votes on 14 December 2020 is known before we settle the markets. This, of course, assumes that there is no conclusive outcome before this date”.

Had Betfair’s traders looked beyond the mainstream media, they would have seen that legally there are dozens of ongoing legal Challenges.

As an example, on December 14th the Supreme Court made a judgement in favour of the Trump campaign to say that Wisconsin erred in allowing over 250,000 voters to self-certify that they were unable to travel to vote. All the Trump team needs to do now is do the legwork with those voters to overturn the certification of Wisconsin for Biden.

There are ongoing recounts in Georgia and signature matching orders, which will almost undoubtedly turn over the state to Trump.

What is most important here is that the day Betfair chose to settle this market was literally the worst day they could have done so from a legal standpoint, because it was the first day since election day that the projected electors were thrown into legally recognised dispute, by the aforementioned states in the third paragraph above officially & legally sending electors for Trump.

This is a financial bombshell for the company and it will impact current shareholders of Flutter/Betfair big if Trump wins – those hundreds of millions in bets will ordered to be paid out by judges. The legal case is clear cut – they called Trump bets losers based on projected electors suddenly being known, when that criteria was met weeks before. It could be argued that Betfair knew they would never pay out on those new bets because even with the ongoing legal disputes, everyone on both sides of the debate knew that the electors day of December 14th would see no change to the projected electors Biden already had (since November 4th). This could be deemed fraud.

There were hundreds of millions bet by political punters at odds in the range of 10-37/1 for Trump in the days Betfair kept the market open, Betfair are now liable for those bets from their own company funds if Trump wins, because they have paid out the people who took those bets with Trump-backer’s money.

If Trump loses, the company will still be ordered to refund all bets made after December 4th and possibly even November 4th, because they misled customers on the nature and rationale of settling based on projected electors. On November 5th they said the following on their website here, where much of the evidence sits:

The company also gave no warning to punters so they could trade out of their positions, and there is massive evidence they deliberately led customers on to say the market would be kept open pending legal challenges, even up to the evening of December the 15th.

The 12th Constitutional Amendment reference

As you see in the bolded paragraph above on Betfair’s market rules, Betfair state that in the event no candidate receives the required projected votes, the market will be settled based on the procedures of the 12th Amendment for certifying the election. The 12th amendment which provides the procedure for electing the President and Vice President. The only date throughout the entire constitution relating to the election is January 20th. And Congress generally meets on the 6th to count the electoral votes. The date of the 14th of December (when Betfair erroneously settled the market) is a Federal statute only and has been shown by the Amistad project to be essentially meaningless in the election outcome.

By mentioning the constitution, Betfair have made another blunder, because it doesn’t mention the date of December 8th or 14th, yet the mention suggests that they were aware of the constitutional implications of the 12th amendment – more potential misleading of customers to think the market would stay open to at least the 6th.

By keeping the market open beyond the date of California’s certification of their electors (December 4th, and arguably November 4th per the above) Betfair lost the defence of settling the market yesterday based on projected elector numbers.

Their only fallback then is the 12th amendment, which procedurally only refers to inauguration day January 20th. Betfair should have signalled closure of the market to customers in the past few days, and sought legal advice on the matter from competent lawyers. They would have likely advised freezing the market until the outcome was known.

Why did Betfair leave the market open AFTER Projected electors were known?

This is speculation, but the company were no doubt looking at 50 to 100 million in commissions, which was no doubt tempting. This could also be political correctness gone mad – liberal media has waged an all-out assault on the truth in recent weeks – refusing to cover the ongoing legal cases and significant legal gains being made by the Trump team. We have been covering them in almost daily election updates here. The mainstream media have failed to cover the clear instances of voter fraud, and covered only the court defeats for Trump and none of his victories.

Betfair made an announcement on their website late last night to say that they had consulted their lawyers on this issue prior to settlement. They may be counting on punters not following up on the actual law. It could be that the 50Million plus in commissions that Betfair earned from this move fed a lot of executive Christmas bonuses and revenue milestone bonuses for the year. It certainly doesn’t look like they looked at the legal facts clearly.

Sources have told us about well-known cost cutting programs across Paddy Power/Betfair (their IT staff are hugely under resourced and their market trading team has been outsourced to faulty automated trading algorithms in most cases). It is therefore reasonable to assume that they may not have actually sought legal advice at all.

And if they did, penny pinching means it may have been cut-price. Not so much Saul Goodman as Lionel Hutz, Attorney at law. No, money down!

Wider corporate governance implications

Beyond the obvious impact to people who had bet hundreds of millions on Trump to ‘Be the Next President’ in good faith, because they were doing their due diligence and market research, there are wider corporate governance implications.

The maintenance by Betfair of an open market could be deemed as fraudulent and insider trading from a gambling perspective (insiders at the company could have been taking a share of the billion euro in bets on Trump knowing that the market would be settled without warning on the 14th). There could also be insider trading and corporate governance implications from a financial markets perspective.

One possibility is the shorting of Flutter entertainment shares. Shorting essentially involves an investor borrowing a stock, selling the stock they have borrowed on the open market, and then buying the stock back to return it to the lender on the agreed return due date. They make their money when they can buy the stock at a lower value at a point in the future when they have to give it back. Borrow ten shares for six months while the price is $100, then sell them for $1000. In 6 months when you have to give the shares back, if the price is $50 and you buy ten shares on the market, it has only cost you $500. You have then made $500.

Would a half a billion euro hit impact the stock market price for Flutter Entertainment? We think so. If you made any kind of a gamble on the stock price to go down and knew this potential con was taking place, you’re guilty of securities fraud.

Legal action has started

Within hours of the market closure last night Facebook groups had sprung up planning class action lawsuits across Australia against Betfair/Paddy Power. We invite all such groups to post links to their pages below in the comments.

Many of these people backed Trump at odds of up to 36/1, and they did so based on Betfair’s communications regarding the market. You can find one such group in Australia here – expect many more class action suits to be generated in their global territories as awareness grows.

Trump has had massive gains in the election battle this week, this video is a useful primer for those still on crash diet of mainstream media news. Trump also has the 2018 executive order that allows him to declare foreign interference in the US presidential election. Skip to 9:15 in the video above for details on that. It is the authors opinion that the election report will have detailed evidence-based conclusions of foreign interference. The executive order is very real.

Betfair gambled and lost, bigly

According to one legal mind we spoke to, the legal case is crystal clear in relation to the US electors situation and Betfair’s contradictory market advice, Presidential electors situation, and Betfair’s subsequent actions. Betfair broke their own rules and sent conflicting messages to customers, took their money, then reneged on those rules.

They are liable for at least of hundreds of millions in Trump-bet refunds. If Trump wins out based on state legislatures (politicians, not the courts) ruling that there was widespread voter fraud in five key cities (which is looking more and more likely by the day), they will owe much more.

With legal cost awards added to the owing bet payment tallies they now owe (having settled the market as a winner for the other side), Betfair/Flutter are going to regret not freezing the market and getting a second legal opinion. And those holding Flutter Entertainment stock may want to investigate what management were up to. Better Call Saul.

We will update this story every time there is a development. There is an image resource below with further evidence that we found when compiling this story, for those looking for more evidence and reference points. Comments are below. Please share this story with any gamblers you know, we’re not on social media.

Check out our home page for the most original global news analysis on the interweb

Related

- US CDC – “NO real reduction in VIRAL transmission with face-masks”

- Is Luke O’Neill a Trojan Horse for Mandatory Vaccines? – Special Report –

- Why Lockdowns? The Irish Government are now a Narco-State

- Level 5 lockdown – Four reasons why NPHET want it…

- Medical Professionals expose Sinn Fein, Media, & Mehole Martin’s lies…

- Lockdowns – How Many Irish Politicians Are Being Bribed By China?…

- The Mother & Baby Home Political Coverup – Two Reasons Why…

- Mary Lou McDonald And The Covid-19 Vaccine Connection…

- The Emperor Has No Covid-19 – Long Read

- How A Covid-19 Vaccine Poll Becomes A Big Pharma Propaganda Tool…

Evidence vault, comments below. Click on any image to reveal gallery, arrow right and left to scroll